Headings – Outfit

Visual reference for default H1 heading: quirky jived boxes exemplify strong typography.

Default H2 styling shown: jumpy text vexes bold, quirky graphics..

Typography demo for H3: blazing fonts jump, vex quick wizard text.

H4 preview: quick brown wizard jumps, vexing bold glyphs.

Body Text – Inter

This body text serves as a visual reference for paragraph styling, line height, and typographic rhythm in standard content layouts. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Quisque fermentum, quam in pulvinar luctus, nulla felis volutpat tortor, nec sagittis lorem nisi a turpis. Integer vulputate, urna a tempus lacinia, velit neque volutpat sapien, ut cursus arcu risus at augue. Praesent ut lorem quis turpis lacinia congue. Curabitur posuere turpis nec lorem convallis, non rhoncus nisi varius. Phasellus efficitur eros at metus aliquam, et porta nisi sollicitudin. Suspendisse potenti.

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Nemo enim ipsam voluptatem quia voluptas sit aspernatur aut odit aut fugit. Ut enim ad minima veniam, quis nostrum exercitationem ullam corporis suscipit laboriosam, nisi ut aliquid ex ea commodi consequatur.

Authority-Led Gatekeeping Engines for High-Value Client Acquisition.

The Pause Between captures moments of stillness and transition—those quiet spaces where thought and feeling blur. Each painting reflects a tension between movement and calm, inviting quiet reflection.

Created with layered oils, the works combine soft glazes and bold strokes. This interplay of texture and restraint mirrors the theme: what happens in the spaces we often overlook.

Tagline

A compelling opening message

Write a clear concise description of the product or services you offer.

What we do

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat.

Point 1 summary

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique.

Point 2 summary

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique.

Point 3 summary

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique.

Feature

Introduce your main service or a feature and the benefits

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat.

-

Feature 1

Provide a short summary of the main features, the problems it solves and the benefits it deliver

-

Feature 2

Provide a short summary of the main features, the problems it solves and the benefits it deliver

-

Feature 3

Provide a short summary of the main features, the problems it solves and the benefits it deliver

Proof

Some key information & metrics

-

200x

Productivity improvement

-

1000+

5 Star Reviews

-

500%

Increase Yield

-

100k+

Happy Customers

An exciting and compelling call to action.

A clear message to entice your visit to try your service.

Frequently Asked Questions

Question text one

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros eleentum tristique. Duis cursus, mi quis viverra ornare, erosdolor interdum nulla, ut commodo diam libero vitae erat

Question text two

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros eleentum tristique. Duis cursus, mi quis viverra ornare, erosdolor interdum nulla, ut commodo diam libero vitae erat

Question text three

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros eleentum tristique. Duis cursus, mi quis viverra ornare, erosdolor interdum nulla, ut commodo diam libero vitae erat

Question text four

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros eleentum tristique. Duis cursus, mi quis viverra ornare, erosdolor interdum nulla, ut commodo diam libero vitae erat

Question text five

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros eleentum tristique. Duis cursus, mi quis viverra ornare, erosdolor interdum nulla, ut commodo diam libero vitae erat

Resources

Introduce some key resources from your blog page.

A description of what your company does and why

Write a clear concise description of the product or services you offer.

Values

Share you core values

Value 1

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat.

Value 2

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat.

Value 3

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat.

Stats

Demonstrate company performance with stats

-

200x

Productivity improvement

-

1000+

5 Star Reviews

-

500%

Increase Yield

-

100k+

Happy Customers

Partners

Our Partners

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat.

The Team

Authority-Led Gatekeeping Engines for High-Value Client Acquisition.

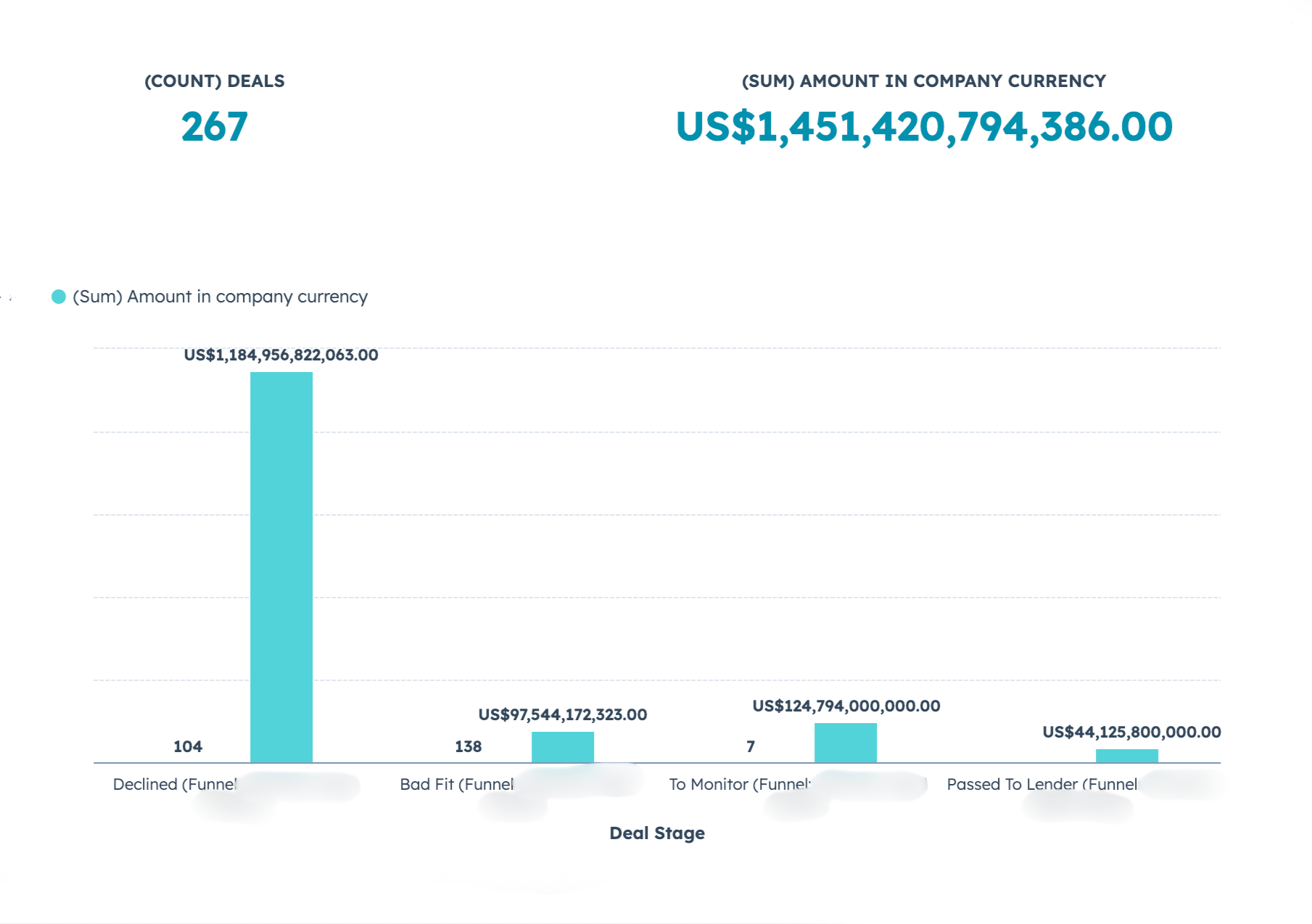

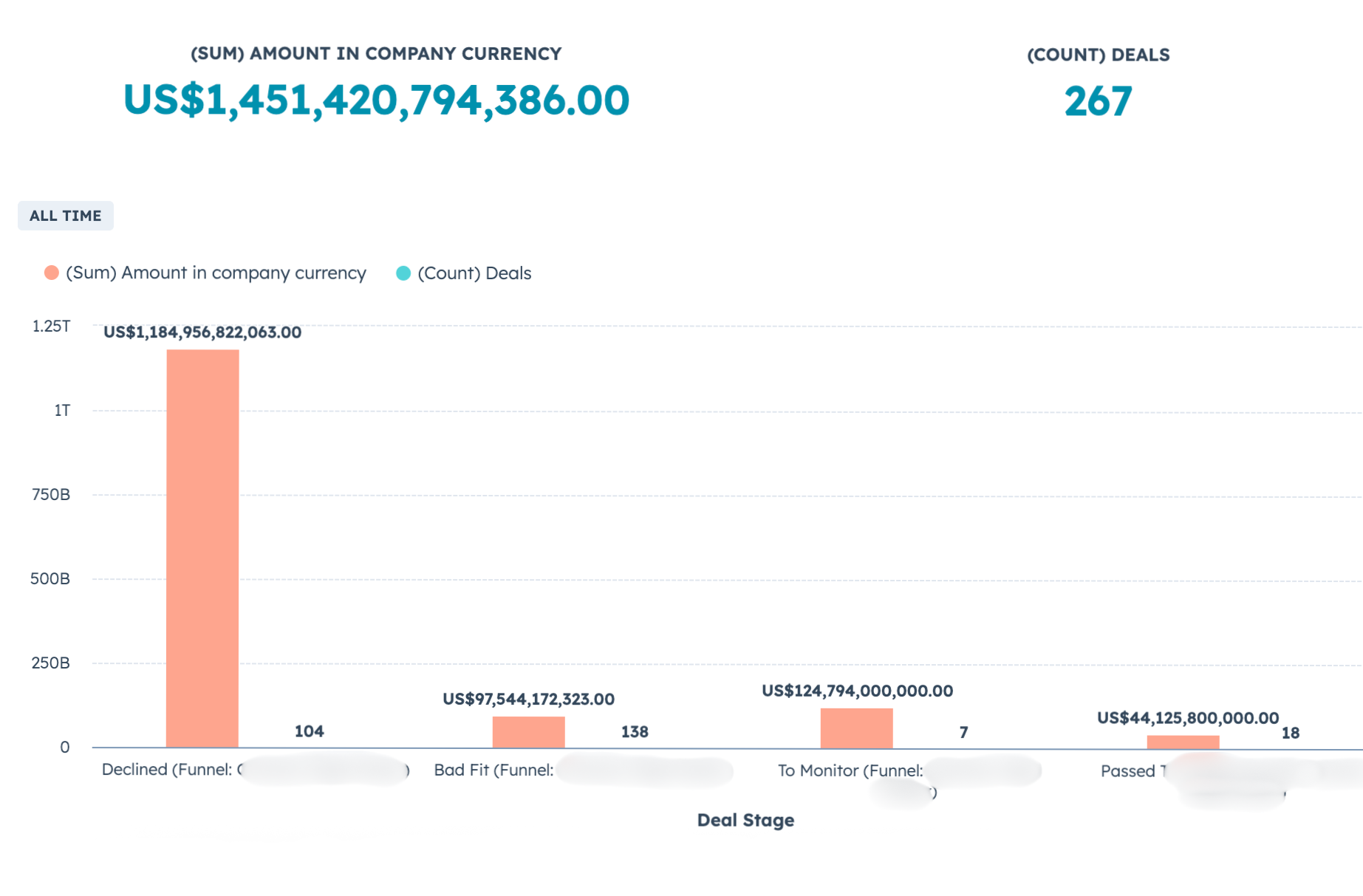

PROOF

Proof: AltFin.net

Proven in $100M+ Project Finance

Our flagship engine, AltFin.net, has generated nearly $1.5 trillion finance inquires-without ads, networking and calls.

For lenders: clean, compliant, collateral-backed projects.

For sponsors: one streamlined application, direct to private debt funds.

Partners

Our Partners

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat.

Frequently Asked Questions

Question text one

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros eleentum tristique. Duis cursus, mi quis viverra ornare, erosdolor interdum nulla, ut commodo diam libero vitae erat

Question text two

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros eleentum tristique. Duis cursus, mi quis viverra ornare, erosdolor interdum nulla, ut commodo diam libero vitae erat

Question text three

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros eleentum tristique. Duis cursus, mi quis viverra ornare, erosdolor interdum nulla, ut commodo diam libero vitae erat

Question text four

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros eleentum tristique. Duis cursus, mi quis viverra ornare, erosdolor interdum nulla, ut commodo diam libero vitae erat

Question text five

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros eleentum tristique. Duis cursus, mi quis viverra ornare, erosdolor interdum nulla, ut commodo diam libero vitae erat

Let’s work together

Lorem ipsum amet elit morbi dolor tortor. Vivamus eget mollis nostra ullam corper. Natoque tellus semper taciti nostra. Semper pharetra montes habitant congue integer nullam. Magnis nulla maximus integer primis vivamus.

Thank you for your time!

– Marc Painter

ENGAGEMENT MODELS

Two Pathways

- AltFin.net Placement — structured intake at scale through our proprietary engine, where an offer–engine fit exists.

- Dedicated Engine Licensing — dedicated origination systems hosted and operated by ScaleOn, licensed exclusively to your institution. Engines are never transferred; ScaleOn retains ownership and operational control.

Result: structured origination at scale, without noise.

What We’ve Built

Our origination systems have powered:

$1.45+ trillion in originated deal flow for a global lender with $250B+ book value specializing in finance for large-scale infrastructure and commercial projects

$44B+ under negotiation

850+ prospects for $1.2B AUM investor acquisition pipeline

Who We Are

ScaleOn designs and operates proprietary origination systems for private and institutional capital allocators.

Our infrastructure replaces broken funnels with structured systems that filter, pre-qualify, and deliver decision-ready deal flow at scale.

What We Do

Conventional marketing and funnels collapse when the stakes involve billions, compliance, and global players.

When a deal is worth hundreds of millions or billions, chaos is the default: fragmented intake, weak sponsor qualification, and opaque pipelines block capital from moving efficiently.

ScaleOn was created to replace that chaos with structured origination at institutional scale. Our proprietary funnels provide:

- Systemized intake aligned to institutional requirements

- Automated filtration and AI-assisted pre-qualification for compliance, scale, and collateral

- Standardized, decision-ready outputs

Funnel deployments take two forms:

- Offer placement on AltFin.net – a structured intake through our proprietary funnel, for offers where there is an offer–funnel fit.

- Dedicated licensed builds – ScaleOn deploys proprietary origination funnels as dedicated, single-tenant environments for institutions requiring exclusivity or a specific vertical. ScaleOn retains ownership and operational control; clients license the funnel and receive dedicated reporting and outputs.

About ScaleOn

What We Do

We design structured origination systems that turn incoming inquiries into pre-qualified, decision-ready deal packages for capital allocators. Our system filters, standardizes, and presents vetted deal opportunities so institutional capital providers can act efficiently, without noise or manual screening.

The Problem

In institutional and private markets, traditional marketing fails:

- Compliance restrictions limit what you can advertise.

- Ineligible applicants waste your time and erode authority.

- Standard lead-gen clogs your pipeline with noise instead of capital-ready opportunities.

The Solution

ScaleOn designs origination systems that produce vetted, decision-ready deal flow at institutional scale:

- Filtered, vetted inquiries

- Decision-ready packages

- Time and resource savings

- Standardized, audit-ready output

Proof of Execution

Our systems have powered investor and deal acquisition pipelines in high-value capital markets:

- $1.45 trillion originated deal flow for a private institutional lender with a $250B+ book value lending to large-scale infrastructure and commercial development projects.

- 850+ prospects generated for the North American investment manager with a $2.5B+ CRE portfolio.

ScaleOn is not theory. It’s tested, running, and proven.

Proven live: intake funnels built, tested, and optimized across capital market contexts.

Choose your Headline Level

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat.

Choose your Headline Level

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat.

Choose your Headline Level

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat.

Choose your Headline Level

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat.

Ready to accelerate?

An exciting and compelling call to action.

A clear message to entice your visit to try your service.

The Team

Systems Architect

Beata is the mind behind Altfin.net’s $1.45T+ deal flow origination, designing systems that enable institutional capital to move efficiently and at scale. Her background includes trusted work with:

- European Investment Bank

- European Commission

- Lloyds Bank

- Barratt Homes

- $250B+ Project Finance Lenders

Sign up for updates on ScaleOn origination systems and institutional capital insights.

Gatekeeping Deal Origination Systems for Capital Providers

That filter noise and deliver pre-qualified deals – proven on AltFin.net:

1.3k+ mandates screened

$1.45T+ deal value originated for our institutional partners

ALTFIN.NET PERFORMANCE METRICS

Custom Gatekeeping Funnel for Origination at Scale

1.5k+

INQUIRES PROCESSED

Filtered, Pre-Qualified, Actionable

$1.45T+

dEAL VALUE ORIGINATED

Logged and Traceable

1.3k+

INQUIRERS SCREENED

Institutional-Scale Volume

Are you a capital allocator seeking structured origination?

We carefully vet potential partnerships, as we have limited spaces available. Reach out now to to see if we are a fit.

CASE STUDY

Case Study: AltFin.net Origination Engine for a Private Institutional Lender

The Problem

The lender had no functional public presence: an unsearchable website, no SEO footprint, and no scalable way to communicate their offer.

All intake was manual. They were overwhelmed by ineligible inquiries, daisy chains, introducers demanding fees, and poorly structured submissions.

Qualified projects could not be distinguished from noise, and internal capacity was wasted on screening rather than evaluation.

The Objective

Create an external origination engine that attracts, filters, and structures only institution-ready projects – without exposing the lender publicly and without increasing internal operational load.

What We Do

ScaleOn designs, builds and operates external origination aligned with the capital provider’s offer that sources, filters, and delivers only pre-qualified, lender-ready deal opportunities to capital allocators.

Our system replaces manual screening, removes intermediaries, and standardizes submissions so capital allocators only receive vetted, decision-ready deals.

The result: consistent, credible, traceable deal flow at an institutional scale for lenders who cannot run public marketing or handle unstructured inbound.

The Problem

Most deal flow capital providers receive is not eligible: wrong jurisdictions, weak sponsors, unclear mandates, or chains of intermediaries recycling the same projects.

Standard lead-gen tools push volume, not quality.

As a result capital allocators lose time screening noise instead of deploying capital.

Our Solution

We build gatekeeping origination platforms engineered for capital allocators.

Each funnel filters out ineligible enquiries, qualifies viable opportunities, and delivers decision-ready submissions your team can evaluate immediately.

You get fewer but higher-quality deal opportunities originated by our systems.

OUR FUNNELS

What We’ve Built

Our systems have powered investor and deal pipelines in high-value capital markets:

$1.45+ trillion deal flow originated for a global lender with $250B+ book value

$44B+ deal value under negotiation

850+ investor prospects for the $2.5B CRE portfolio for US investment manager

WE WORK IN

Areas We Cover

Project Finance

Infrastructure and Construction Financing

Hospitality and Real Estate Development

Renewable Energy Finance

Asset-Based Loans

Not for bonds, SBLCs, off-market instruments.

OUR OFFER

What We Do

ScaleOn designs, builds and operates external origination aligned with the capital provider’s offer that sources, filters, and delivers only pre-qualified, lender-ready deal opportunities to capital allocators.

Our system replaces manual screening, removes intermediaries, and standardizes submissions so capital allocators only receive vetted, decision-ready deals.

The result: consistent, credible, traceable deal flow at an institutional scale for lenders who cannot run public marketing or handle unstructured inbound.

The Problem

Most capital providers are flooded with unqualified, unverified, and non-actionable deal flow. They face recurring issues such as:

- Overwhelmed by inbound noise: brokers, daisy-chains, fee-hunters, and recycled decks.

- Internal time wasted filtering out incomplete, unverifiable, or non-institutional submissions.

- No way to validate mandate, authority, or credibility of the party submitting the deal.

- Projects arriving with missing collateral proof, weak developers, or no SPV/structure.

- Confusion created by intermediaries presenting mismatched, non-bankable proposals.

- Difficulty securing clean, first-line access to developers who actually meet underwriting standards.

- Inconsistent formats: every deal arrives differently, slowing assessment and increasing friction.

- Reputational risk when relying on informal channels for origination instead of a controlled intake.

Our Solution

ScaleOn builds a controlled origination engine that eliminates noise and delivers only institution-ready opportunities:

- A dedicated, external intake platform aligned with the lender’s mandate and underwriting model.

- Structured qualification that filters out unqualified parties before they ever reach the lender.

- A standardised intake form capturing all data required for institutional-level assessment.

- Document capture, collateral verification, and automated pre-screening for completeness.

- Eligibility rules that block daisy-chains, unverifiable brokers, or mismatched proposals.

- Screening outputs summarised into a clean, concise, decision-ready package.

- A gatekeeping layer protecting the lender’s confidentiality and saving internal time.

- Delivery only of projects that meet financial, structural, and counterparty criteria.

What We’ve Built

Our systems have powered investor and deal pipelines in high-value capital markets:

$1.45+ trillion deal flow originated for a global lender with $250B+ book value

$44B+ deal value under negotiation

850+ investor prospects for the $2.5B CRE portfolio for US investment manager

SOURCING FOR

Sectors We Cover

Project Finance

Infrastructure and Construction Financing

Hospitality and Real Estate Development

Renewable Energy Finance

Acquisition Financing

Nor for bonds, SBLCs, off-market instruments.