Project Origination for a Project Finance Lender

CASE STUDY

CASE STUDY

AltFin.net Origination Engine for a Private Institutional Lender

This case study explains how ScaleOn built and operates the external origination engine AltFin.net for a $250B+ book value private credit institutional lender that sources, pre-qualifies, and routes investment-ready deals to the lender.

The Problem

- No reliable and scalable way to communicate their financial product

- No functional public presence (unsearchable, outdated site)

- Credibility issues caused by a broker-run frontend

- No systemized intake: all funding inquiries routed through brokers, introducer chains, and fee-seeking intermediaries

- Majority of inquiries ineligible, incomplete, or unverifiable

- Internal time wasted screening noise instead of assessing viable projects

The Objective

- Create external origination that attracts only institution-ready projects

- Protect lender’s confidentiality and relationship-based operating model

- Eliminate introducer chains and non-eligible submissions

- Reduce internal workload by delivering decision-ready packages only

Why External Origination

External gatekeeper AltFin.net:

- Ensures controlled access without exposing lender’s brand, team and processes

- Preserves lender’s high-confidentiality, relationship-based operating model

- Runs the systemized project intake that filters and deliveries warm, pre-qualified projects without broker friction

OUR SOLUTION

The Solution – What ScaleOn Built

ScaleOn built and operates AltFin.net as a controlled, market-facing origination stack that positions the lender’s financial product and removes all manual pre-screening on their side:

- Digital positioning replacing the lender’s invisible public footprint, based on their actual financial product: project finance from $100M to $5B+.

- Controlled acquisition funnel that eliminates ineligible applicants, broker chains, and verifies submitter’s mandate/retainer status before an inquiry enters the pipeline.

- Collateral-focused qualification aligned with institutional private-debt standards.

- Standardised intake with an optimised form, document capture, and strict eligibility filters.

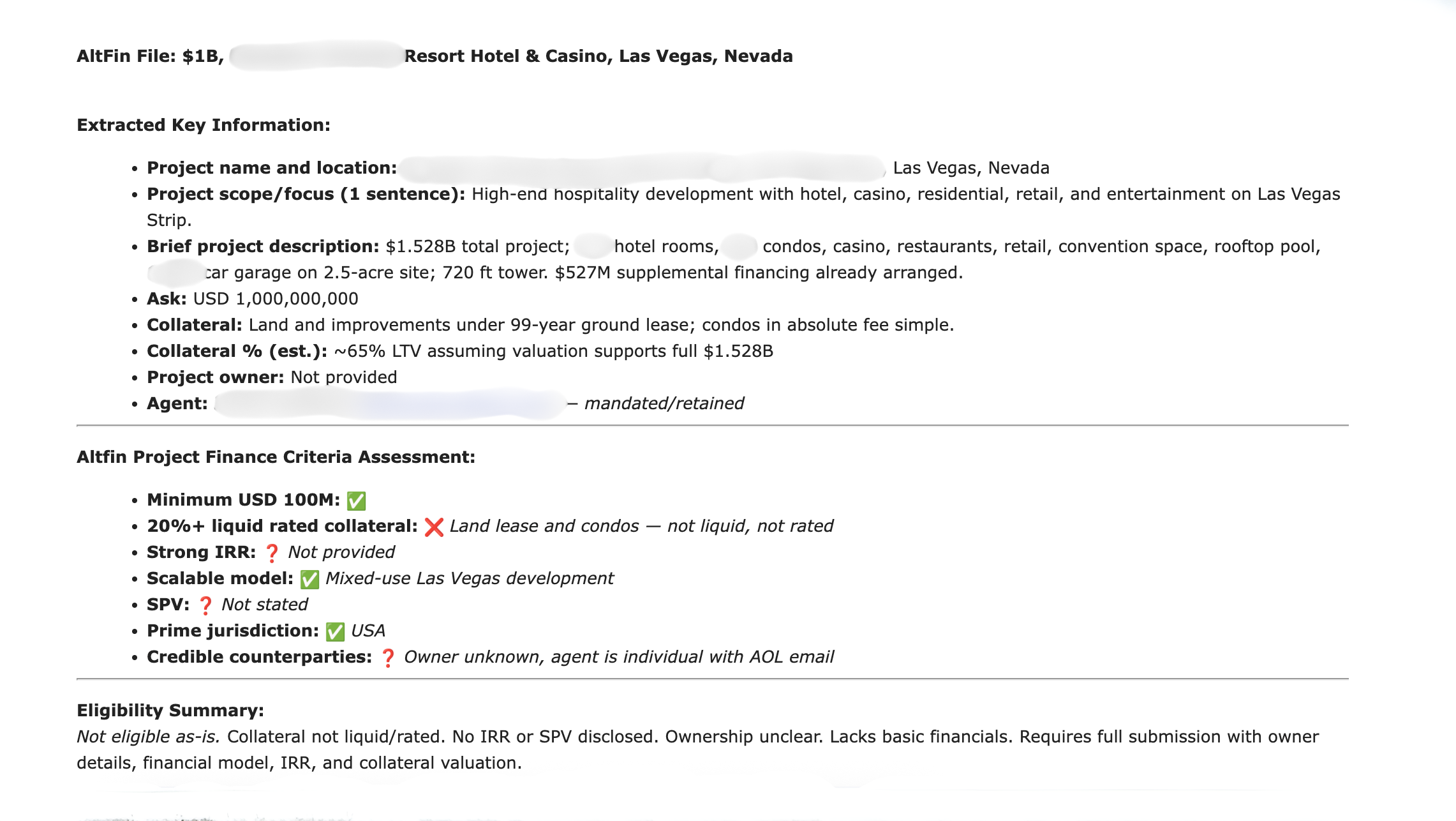

- Al-based screening output producing a one-page institutional summary for rapid lender decisioning.

- Intro-only workflow: the lender receives only pre-qualified, decision-ready packages – no noise, no manual triage.

PERFORMANCE METRICS

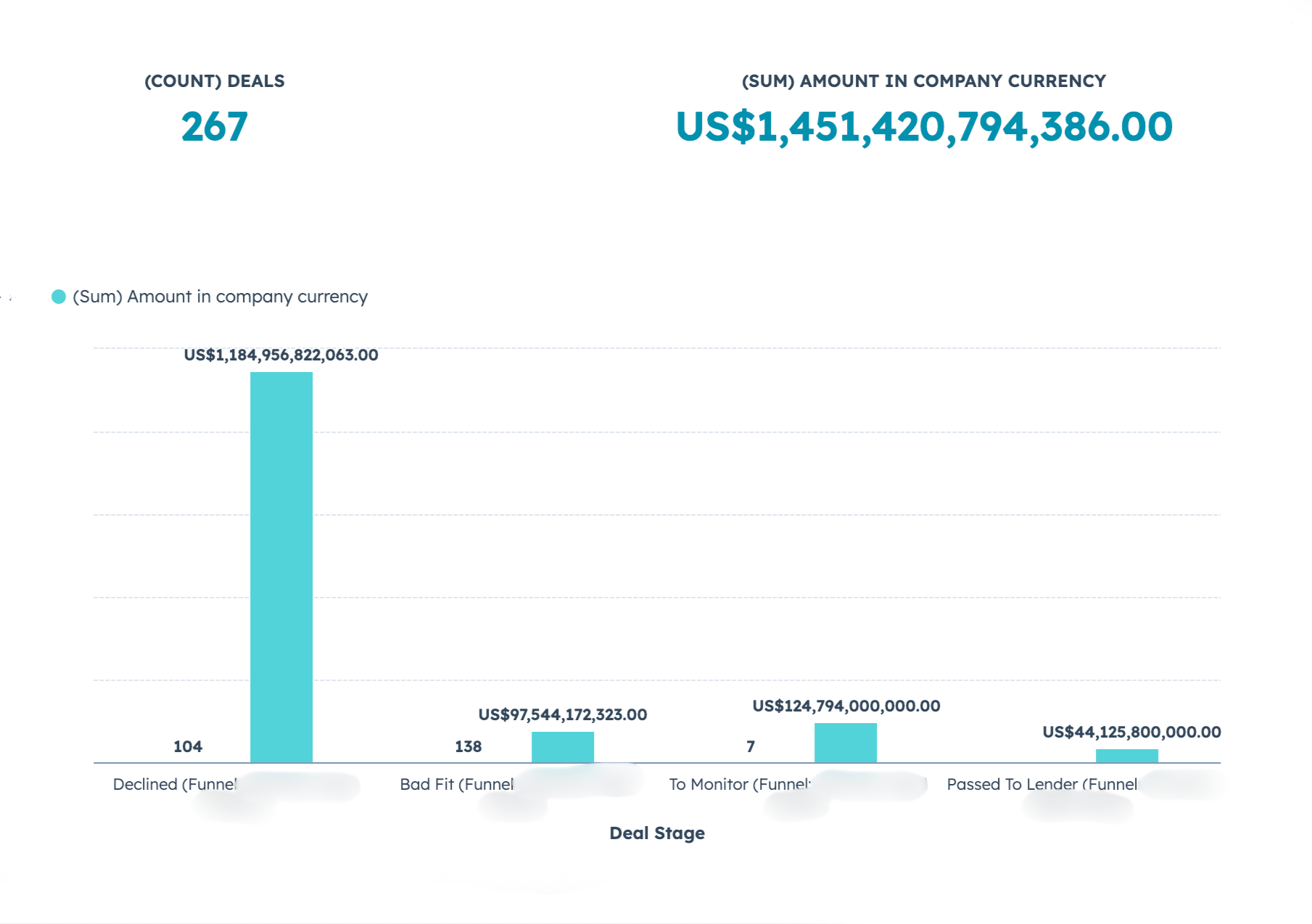

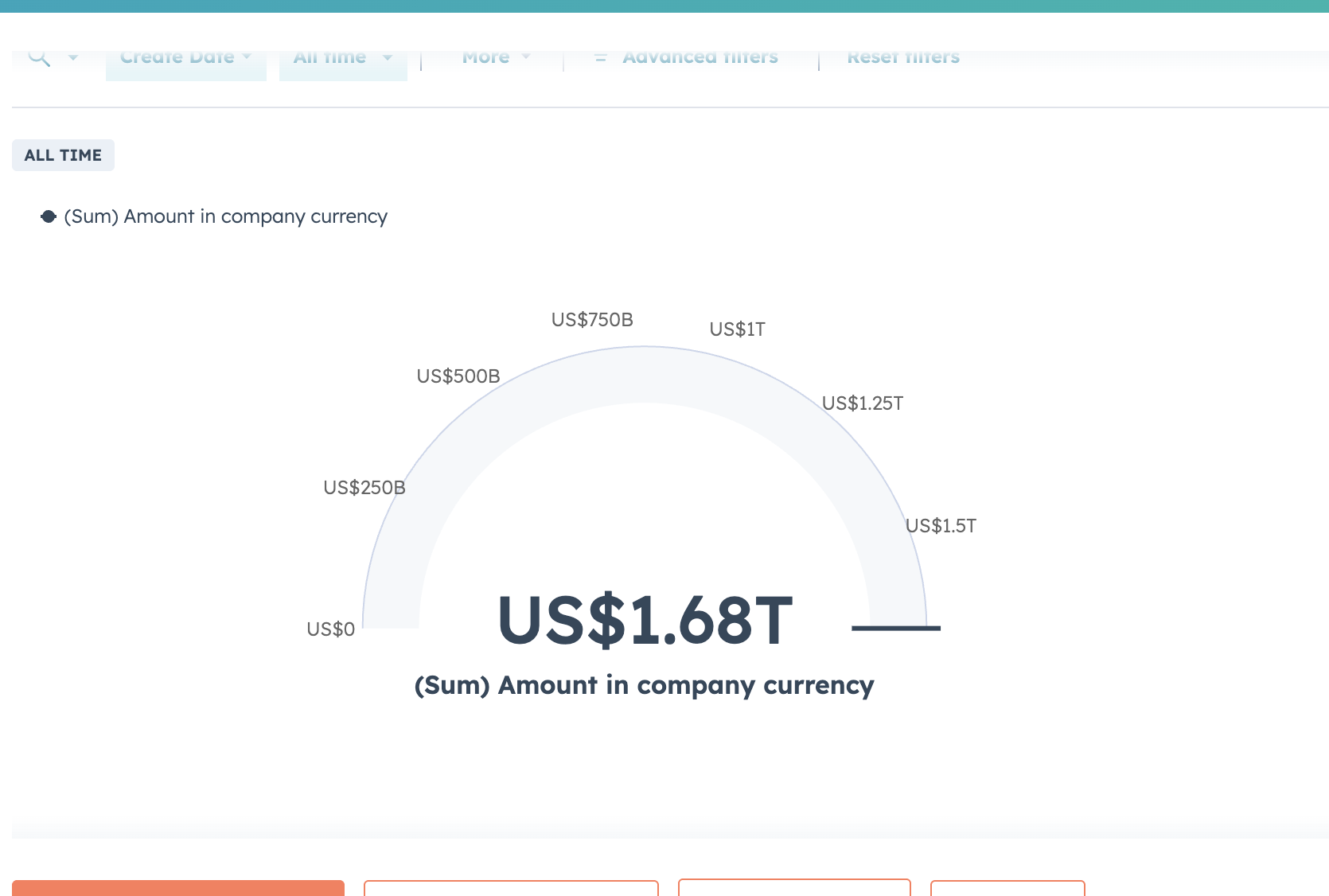

AltFin.net Results

-

1.3k+

Projects screened

-

267+

Institutional submissions

-

$1.45T+

Deal flow originated

-

$44B+

Under negotiations

AltFin.net delivers decision-ready summaries that remove manual screening, reduce internal workload, and accelerate lender review and credit-committee decisions.

DELIVERABLES

What Lands in Lender’s Inbox

A single, standardised package:

- One-page summary (key metrics, collateral, economics, risks)

- Submitted supporting documents (investment deck, financials, etc.)

- Clear decision point: approve or decline introduction

OUTCOME

The Outcome

ScaleOn converted an unsystemized, relationship-only funding model into a scalable, digital origination pipeline – without changing the lender’s internal processes and without compromising confidentiality.

Capital provider seeking pre-qualified deal flow?

Reach out to see if we are a fit.